About Us

When we started our hard money lending company, it was a much different time. It was late 2007 and the whole real estate world had just crashed. Homeowners and investors alike saw their properties lose a ton of value and many fell into foreclosure. Private lenders saw their investor capital disappear. Banks got hit so bad that they had to be bailed out by the federal government.

And here we are saying to each other, “You know, I think the hard money model is the best one for us….and now seems like a great time to start.” Sounds crazy, doesn’t it?! We didn’t know it at the time, but we were right on both counts!

Our phone started ringing almost immediately. There was a new hard money company in town and they had capital to lend (not much, but some). Right away we saw the power of this business model. Get a few leads, quote a few loans, and before we knew it– we had a check in our hands from our first closing. It wasn’t even that much work….oh and each time a monthly payment was made we got to keep part of it as our servicing fee. Our borrower was happy his deal got funded, the investor was happy with the interest rate return, and of course we were very pleased about the amount of money we just made for a relatively small amount of work.

Now we just had to scale.

We dove right into marketing. Online, offline, in-person sales, you name it and we tried it. We spoke at all of the local events, built a solid presence online, and before we knew it everyone in the local real estate investor community knew the name Hard Money Bankers.

As our loan pipeline grew, our capital base needed to grow as well to meet the demand. This wasn’t an easy task– keep in mind we were still in our 20s, had little to no track record, and investors had a bad taste in their mouths after suffering through the crash that had just happened.

So when it came to raising capital, not only did we have to be quick, we had to be very effective to make it happen.

This led to systems: choosing the right types of investors (and having the discipline to stay away from the wrong ones!), having the most effective materials and presentation, proper follow-up procedures, and most importantly developing the right mindset to make investors want to invest their money with you.

Getting our capital raising process dialed in led to plenty of investor money, referrals, and a capital base that grows organically even to this day, 10 years later.

Next came building a team and employing the right software and systems to make them as efficient and effective as possible. Now we aren’t talking crazy fast growth– that was never our goal. We grew slowly and consistently, adding one new team member each year.

Flash forward to today and HMB has a loan portfolio of $50+ million outstanding, plenty more capital available if we need it, a happy productive team and fun office of 10 people!

We officially started the Private Lenders Podcast in 2018 as we always joked about recording our conversations around the office which were always focus on private and hard money lending.. We finally sat down with a microphone and camera and started talking about our hard money lending operation publicly…

We had an overwhelming amount of other private lenders and investors around the country reach out to us for help and this was the start of the Hard Money Mastermind group. A place where other lenders, brokers and investors could go to learn, chat and network with other likeminded community members. It is the ultimate shortcut to building a profitable hard money lending business.

Enjoy The Hard Money Mastermind Group!

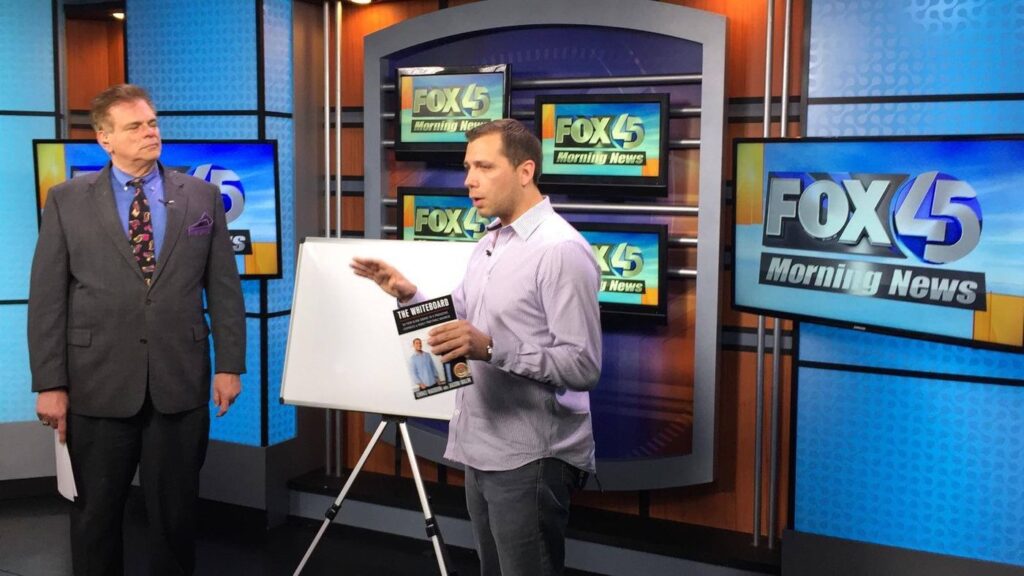

Chris Haddon & Jason Balin